In his new investigation, Yaroslav Zhelezniak examines how sophisticated offshore structures were designed to move, disguise, and ultimately legitimize money linked to Ukraine’s energy sector. The scheme relied on a layered system of island jurisdictions, investment funds, shell companies, and trusts, each chosen for specific legal protections and opacity. This architecture allowed beneficiaries to remain hidden, financial trails to be deliberately broken, and assets to be shielded from courts and law enforcement. By mapping jurisdictions, legal loopholes, and banking routes, the investigation exposes how professional financial engineering can transform illicit proceeds into assets that appear fully lawful on the global market.

Yaroslav Zhelezniak: I promised you a breakdown of the offshore structure of Mindich–Halushchenko.

In short: it was done very intelligently and professionally. If NABU had not seized the documents and received international assistance (I believe from Switzerland), nothing would have been uncovered.

By islands:

Anguilla. Why here specifically? Why not Cyprus or Panama? Because Anguilla specializes not in registering simple shell companies, but investment funds.

And then, when a Swiss bank sees a transfer from an “investment fund” from Anguilla, it looks like legitimate business rather than the laundering of bribes.

Cash from Kyiv is converted into cryptocurrency, and then those digital funds are supposedly used to buy shares in this fund.

But the owners have to be concealed. So in the registry, you will see yet another company. This time, a different offshore is needed — the Marshall Islands. This jurisdiction was not chosen by chance. It is a black hole for information. There is no public register of directors here. All information exists only on paper, somewhere in a safe on an island in the Pacific Ocean.

But the money has been laundered and hidden — how do you protect it from confiscation if NABU still gets to the truth?

This is where the island of Nevis and its trusts come onto the scene. Lawyers call Nevis a hell for creditors.

Nevis does not recognize decisions of foreign courts. Plus, there is a statute of limitations.

In short, a very smart structure… maintaining it alone costs somewhere around $100,000. And considering that Herman was on a salary, it is obvious that it was not built for his money or his needs (but for someone else’s).

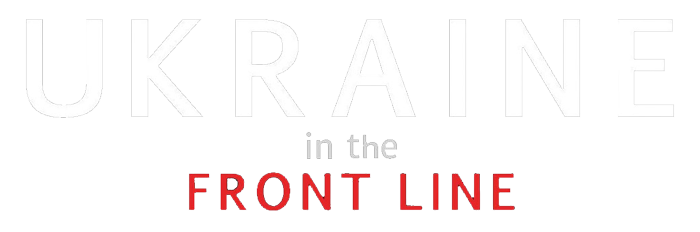

Friends, hello. This video is not about Mindich’s or Halushchenko’s corruption itself, nor about all the others who will 100% surface there; not about Halushchenko’s trial, which is still ongoing and, I think, by the time this video is released he will still be having a preventive measure chosen; and not even about the details. But it will definitely be interesting.

I was genuinely interested in preparing this material for you, because I thought I understood a lot about financial engineering, but you can never stop there. And, to be honest, I didn’t really want to dive into the world of offshore schemes. But in the specific case of Halushchenko, Mindich, Ivor Omson, the Zuckermans, and all the other Ryoshyks and Rockets, I became curious — specifically about what the mechanism looks like. Because the choice of the mechanism by which they all stole money and then legalized it matters.

So this video will be about offshore structures. More precisely, not about all offshore schemes — frankly, even if we spent 1,000 hours, we still wouldn’t cover everything — but about why exactly this particular scheme or structure was chosen to legalize money siphoned from the energy sector and, most likely, also from defense. So I looked into the legislation of those countries, read a lot of materials, analyzed the geography, and, accordingly, who influences these island jurisdictions and where. And I prepared this video for you. It will definitely be interesting, at least so that you understand how strong and professional the team is — and Ivor Omson is truly a professional in his field. Frankly speaking, otherwise the Russian mafia and criminal networks wouldn’t have hired this person to legalize their money, nor would they have managed to systematically steal money from our energy sector for five years.

So today this video will be an explanation in plain language. Lawyers, please forgive me if I simplify things in places — otherwise it would take far too long. So we’ll talk about the islands, their influence, trusts, shells — basically, all of that will be covered in today’s video, specifically using Halushchenko as an example. So with you is Yaroslav Zhelezniak, this is the “Zaliznyi Nardep” channel, and we’re starting.

One more thing: I’m not making a video specifically about offshore jurisdictions, although there is an amazing book called Treasure Islands. I highly recommend it, and this weekend, if I have time, I’ll make a separate video review about offshore systems in general: where they came from, why they exist, and why they are islands. But a short spin-off here: every offshore belongs to some jurisdiction — essentially a major country. It’s either the United Kingdom, Germany, or the United States. Remember this — it will come in handy in this video.

So in this case, the criminal organization of Mindich, Halushchenko, and others had a lot of cash — dirty money from kickbacks — that needed to be legalized. Accordingly, it had to be legalized, taken abroad, and hidden in such a way that neither foreign law enforcement agencies nor our National Anti-Corruption Bureau of Ukraine could get to it. In other words, this money had to be physically moved and laundered.

To do that, they brought in a truly top-tier professional — Ivor Omson. Let me remind you, we made a video about this, and it was done so professionally that, while analyzing this structure, I genuinely began to admire the work of these people. In terms of approach, they did a great job: they made the money extremely inconspicuous and inaccessible to Ukrainian courts and, in general, to law enforcement agencies worldwide. And that’s exactly what we’re going to analyze today.

Again, I won’t go into details about who got what money for what — there are plenty of other videos about that. Let’s just look under the hood, so to speak, of this offshore structure linked to Mindich, Midas, and, specifically in this case, Halushchenko. Today, we’ll effectively open up the legal fortress they built.

We start with the island — or islands — of Anguilla. Don’t confuse it with England. In short, these are Caribbean islands located not far from Puerto Rico. They’re very small — about 15,000 people — but extremely important. Why were all the funds registered there? Let’s be honest: without Google, I didn’t know where they were. These Caribbean islands differ significantly from Cyprus or Panama. They’re not just islands for shell companies — they are islands for investment funds, and those funds are actually there.

Second, it’s a British jurisdiction. Accordingly, when money is transferred — specifically to Swiss banks — it looks normal when it comes from an Anguilla-based fund. Banks don’t question it too much. So in this case, in February — and as we saw from the investigation, even back in December 2020 — the criminal organization set up an investment fund there. We won’t go into the names — there were several — but in short, this was done to legalize the final step of transferring money into Swiss banks, where they then paid for colleges, bought real estate, deposited funds — basically everything — using these criminal proceeds. And to a Swiss bank, it all looked like a legitimate business, because there are many such funds, often created not only to avoid taxes but also to hide their ultimate beneficial owners.

How cash was funneled into these funds — I think you understand: it was converted into cryptocurrency, then supposedly used to buy shares in the fund mimicking an investment. To the outside world and to Swiss banks, it looked like a successful investor investing in some kind of energy startup. In reality, the criminals were just moving stolen money from their left pocket to their right — and legalizing it.

But there’s a nuance here. From this point, several more islands appear. Ownership of such a fund can still be traced, and if you open the registry directly, there could be exposure or leaks. So another company had to be created under this fund — this time not in Anguilla, but in the Marshall Islands. For those who don’t know, they’re near Australia, New Zealand, and Papua New Guinea. Small islands, not under British jurisdiction but more closely linked to the United States. This jurisdiction was chosen deliberately because the Marshall Islands are an information black hole: there are no public registries of directors at all. All information exists only on paper, somewhere in a safe on a Pacific island.

The Marshall Islands serve as a small intermediary in this episode. Their function is to break the chain. If someone asks the fund director, “Where did the investors’ money come from?” he points to the Marshall Islands company and says, “From them.” Who’s behind that — no one knows and cannot obtain the information. Moreover, even requesting that information is prohibited. And documents can always be destroyed, torn up, and the trail hidden.

And this brings us to the most interesting part — the heart of the scheme. These are not the last islands. As I said, the scheme is brilliant: the money is laundered and hidden, but just in case, it must be protected from confiscation — whether by NABU, which did dig in, or by the Federal Bureau of Investigation, or another country’s intelligence agency. And here the third island enters the stage — Nevis and its trusts.

Nevis, also in the Caribbean near Anguilla, is known among lawyers as a “creditors’ hell.” Why? First, Nevis does not recognize rulings from any courts except its own — especially Ukrainian courts. A ruling from the Anti-Corruption Court means nothing there. Second, just to file a claim against a trust, Ukraine would have to post a bond in a local court — huge financial and legal barriers. It’s almost impossible. Third, the statute of limitations in Nevis allows money to be legally hidden from creditors. That’s their specialty, which is why they’re chosen. Transfer assets into a trust for a year or two — and you can forget about them forever.

The most cynical element of the scheme is the people listed as beneficiaries. Literally anyone can be named — children, a dog, a chair. And it’s impossible to verify, just like in the Marshall Islands. That’s why Halushchenko listed his wife and four children there — it’s a classic strategy, and legally it doesn’t even require declaration.

Then comes Nevis, the Marshalls, Anguilla, the investment fund, deposits or transfers to Switzerland — the money is clean, and it’s accepted. That’s how about $7.5 million went to cover various needs of Halushchenko’s family: elite schools, universities, and so on. Everything was structured so that, first, no one could see who was behind it — this only became clear thanks to information obtained during searches; second, it’s unclear how to confiscate it; and third, the structure can always be quickly re-registered. And Ivor Omson has already done that.

In short, this is a powerful and sophisticated structure that ensured data secrecy and, frankly, secrecy of the money itself. It’s not cheap: maintaining such companies on islands costs hundreds of thousands of dollars a year. But it was worth it. It was built by top lawyers who truly understand restructuring — or, as was quoted in court: “If a person can explain where the money came from and taxes were paid, they’re not our client.” This was done by professionals.

We’ve made a video about Ivor — yes, it sounds like advertising — and there are no weak points in the structure. The only weak spot that exposed it wasn’t offshore leaks, but thousands of hours of wiretaps in back offices. Evidence was then found on participants’ phones, and the entire story was reconstructed not through digital trails, not through transactions, and not through document leaks from any offshore registry. This is important, because there were likely many more such offshore structures and funds, serving far more influential people than Halushchenko. The investigation is still ongoing, and Specialized Anti-Corruption Prosecutor’s Office must determine who else stood behind these funds — and, most importantly, for whom they were created.

That’s all. This was Yaroslav Zhelezniak, the “Zaliznyi Nardep” channel. Goodbye, and see you again.

Tags: corruption uncovered empr.media investigation hidden billions Mindich Halushchenko network offshore investigation offshore islands mystery Ukraine elite scandal